philadelphia transfer tax exemption

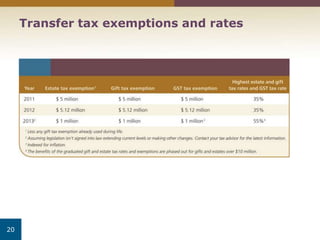

Succession laws is exempt from tax. While this tax adds an extra expense to transferring property there are a number of transfer tax exemptions available which may allow you to avoid paying the tax.

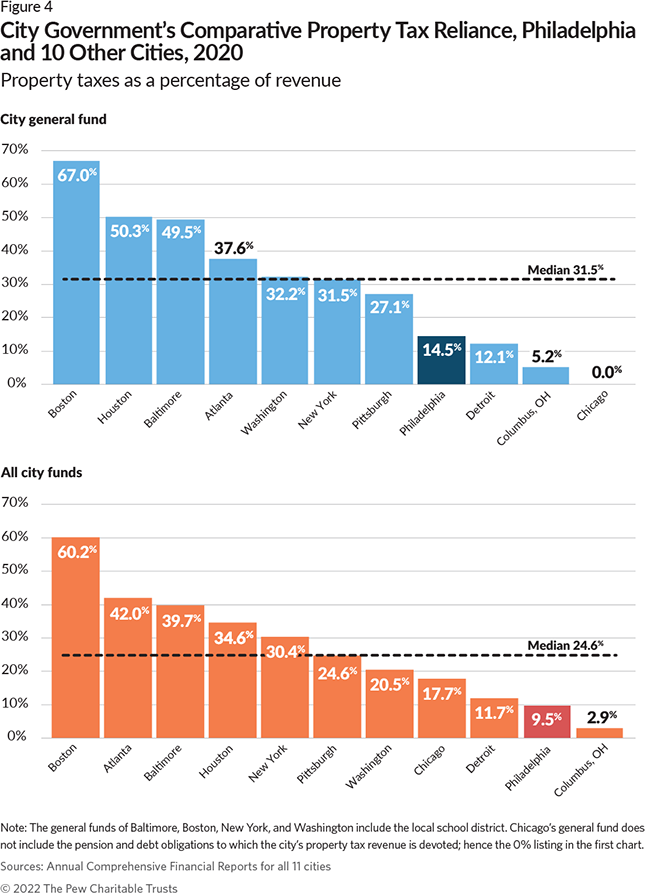

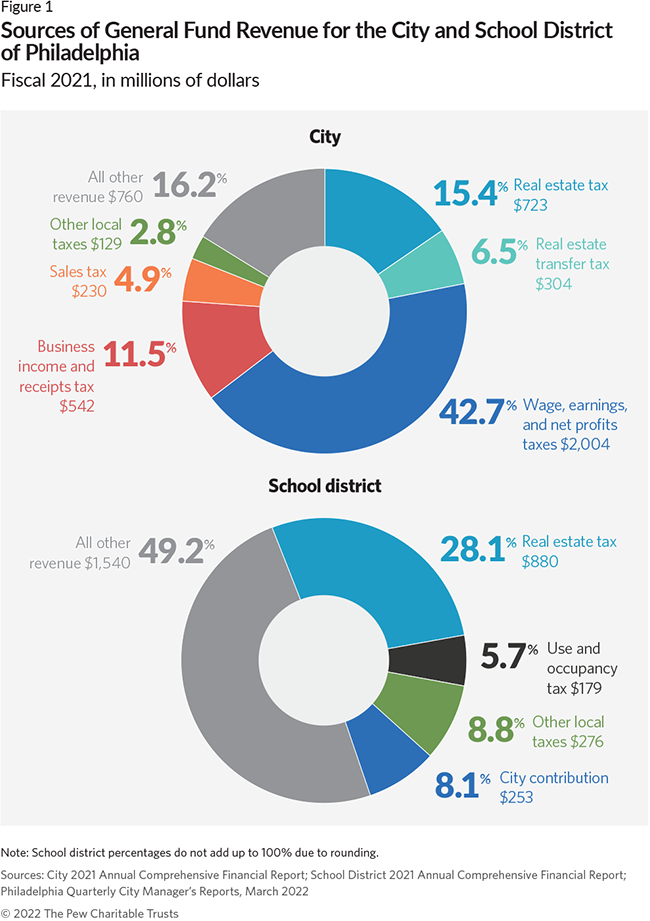

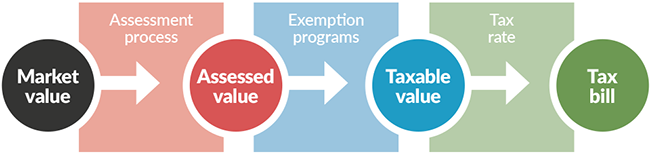

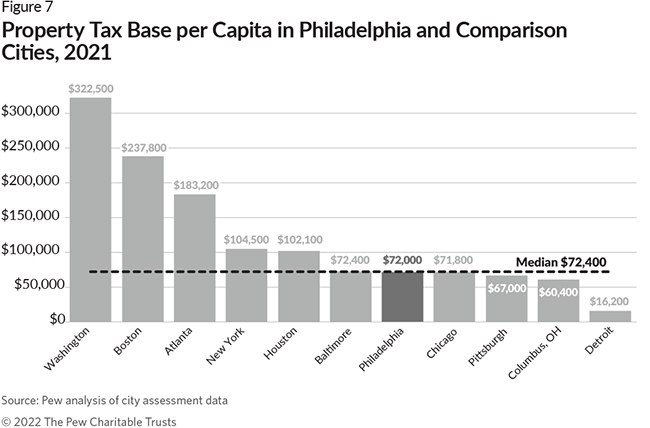

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Transfer To or From Agent or Straw Party - A transfer to or from an agent.

. Philadelphias revenue department is currently updating materials associated with the citys real-estate transfer tax to raise awareness about a 2007 ruling that expanded the. Pennsylvania DOES NOT have a mortgage tax or revenue stamps. You dont have to pay the Realty Transfer Tax if the transfer of home ownership is between family members such as spouses siblings.

Provide the name of the decedent and estate fi le number in the space provided. The Commonwealth imposes a 1 transfer tax on the value of the real estate. With this exemption the propertys assessed value is reduced by 80000.

Realty Transfer Tax regulations. Philadelphias Transfer Tax is Among the Highest in Pennsylvania. When we say exemption what we mean is there are certain times when recording the transfer of a property from one party to another does NOT trigger the need to pay either the.

Deeds to burial sites certain transfers of ownership in real estate companies and farms and property passed by testate or intestate succession are also exempt from the tax. These documents contain the full. The tax clearance section of the Philadelphia Tax Center.

As the name implies the PA deed transfer tax only applies on property transfers ie sales when ownership actually changes. In 2020 youll see that the land is valued at 30315 and the improvements at 171785. The City of Philadelphia imposes a Realty Transfer Tax on the sale or transfer of real property located in Philadelphia.

This exemption also applies to adding a Financially Interdependent Person to your Deed. Some real estate transfers are exempt from realty transfer tax including. Pennsylvania Code section 91193 b 6 is all about transferring property to family members and is by far the most common exemption a real estate attorney like myself comes.

Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. This transfer tax is traditionally split. But you will be subject to other closing costs like title fees and loan fees.

Report a change to lot lines for your property taxes. Philadelphia PA 19107. The Commonwealth imposes a 1 transfer tax on the value of the real estate.

Most homeowners will save about 1119 a year on their Real Estate Tax bill starting in 2023. Philadelphia Transfer Tax Exemption. For counties ranging from Erie Elk Franklin and Centre through Bucks Berks and Butler the fee for a deed transfer is 700 with the exception of Philadelphia which charges.

The tax is prorated in accordance with the percentage of interest being transferred. The following transfers are excluded from the tax. Philadelphias Transfer Tax is Among the Highest in Pennsylvania.

While this tax adds an extra expense to transferring property there are a number of transfer tax exemptions available which may allow you to avoid paying the tax. The transfer tax in Philadelphia is 3 and on transfers for nominal consideration the tax is based upon the Fair Market Value of the property. Effective January 1 2014 all employee Wage Tax refund petitions.

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Pennsylvania Orphans Court Lawsource Includes Book Digital Downlo Bisel Publishing

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Philadelphia Real Estate Transfer Tax Certification City Of Philadelphia Phila Fill Out Sign Online Dochub

Philadelphia Neufchatel Cheese With 1 3 Less Fat Than Cream Cheese 2 Ct Pack 8 Oz Bricks Walmart Com

Get The Homestead Exemption Services City Of Philadelphia

Tax Planning By Isdaner Company Philadelphia Area Certified Public

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Worries Remain Regarding Philly Tax Income Whyy

Real Estate Transfer Taxes Deeds Com

Philadelphia Real Estate Transfer Tax Philadelphia Real Estate Transfer Tax Pdf Pdf4pro

Form 82 127 Download Fillable Pdf Or Fill Online Real Estate Transfer Tax Certification City Of Philadelphia Pennsylvania Templateroller

Real Estate Transfer Tax Montgomery County Local Law Firm

Closing Costs In Philadelphia Buyer S Guide 2022 Prevu

Philadelphia Real Estate Transfer Tax Certification City Of Philadelphia Phila Fill Out Sign Online Dochub

Worries Remain Regarding Philly Tax Income Whyy

Philadelphia Real Estate Transfer Tax Law Offices Of Jason Rabinovich

How Property Is Taxed In Philadelphia The Pew Charitable Trusts